Table of Contents

Over the past few days, some users have been reporting an insurance bug in Pennsylvania.

Approved

A form of professional liability insurance for skilled workers that protects companies, and therefore employees, from claims of negligent performance or mishandling by customers.

Liable error and omission insurance provides coverage for actual losses resulting from alleged wrongdoing in certain insurance jurisdictions after your current retroactive date.

Error and Omission (E&O) insurance will be a type of professional liability insurance designed to provide protection to professionals in addition to the professional services provided by these companies.companies.Another type of professional liability auto insurance is medical malpractice insurance, which is only meant to cover the liability of medical professionals such as doctors and surgeons.

Error and omission insurance, known as error and omission insurance and extended liability insurance, also protects you from lawsuits alleging that you failed to perform your professional services. This insurance package can help your court coverThere may be any costs or charges that could be very costly to your business.

Why Is It Important For Agents In Pennsylvania To Have Error And Omission Insurance?

Insurance agents in Pennsylvania provide vital assistance by providing individuals and organizations with insurance coverage that allows them to take on the risks they face every day with a large pool of insured.Does the insurance industry make it easier and simpler to run a business in Pennsylvania and promise families peace of mind while reducing the impact of unforeseen events?

Error and omission insurance covers records made against Pennsylvania realtors as a result of omissions, torts, or specialized services.The waiver and injunction policies provide for payment of damages and attorney fees (including defense) associated with covered claims.

Do Architects And Engineers In Pennsylvania Needand Insurance Against Errors And Omissions?

Pennsylvania architects and engineers face errors and omissions or malpractice lawsuits based on alleged breaches of contract and incompetenceexercise caution. Pennsylvania Designers & Engineers may be liable for significant damages in the event of liability or simple negligence.

Approved

The ASR Pro repair tool is the solution for a Windows PC that's running slowly, has registry issues, or is infected with malware. This powerful and easy-to-use tool can quickly diagnose and fix your PC, increasing performance, optimizing memory, and improving security in the process. Don't suffer from a sluggish computer any longer - try ASR Pro today!

General Liability Insurance

General Liability Insurance is the backbone of the brand new corporate real estate agent. or a broker’s protection institution, coverage thus extends to client damage, client property, and even advertising damage. Most of the commercial leases you deal with have this coverage.

Error and omission insurance (E&O) is a form of insurance that protects the underlying policyholders from liability in the event of an error.Errors or omissions in the exercise of managerial functions. In general, eg.Policies are designed to cover financial losses, not liability insurance.Bodily injury (BI) and property damage (PD).

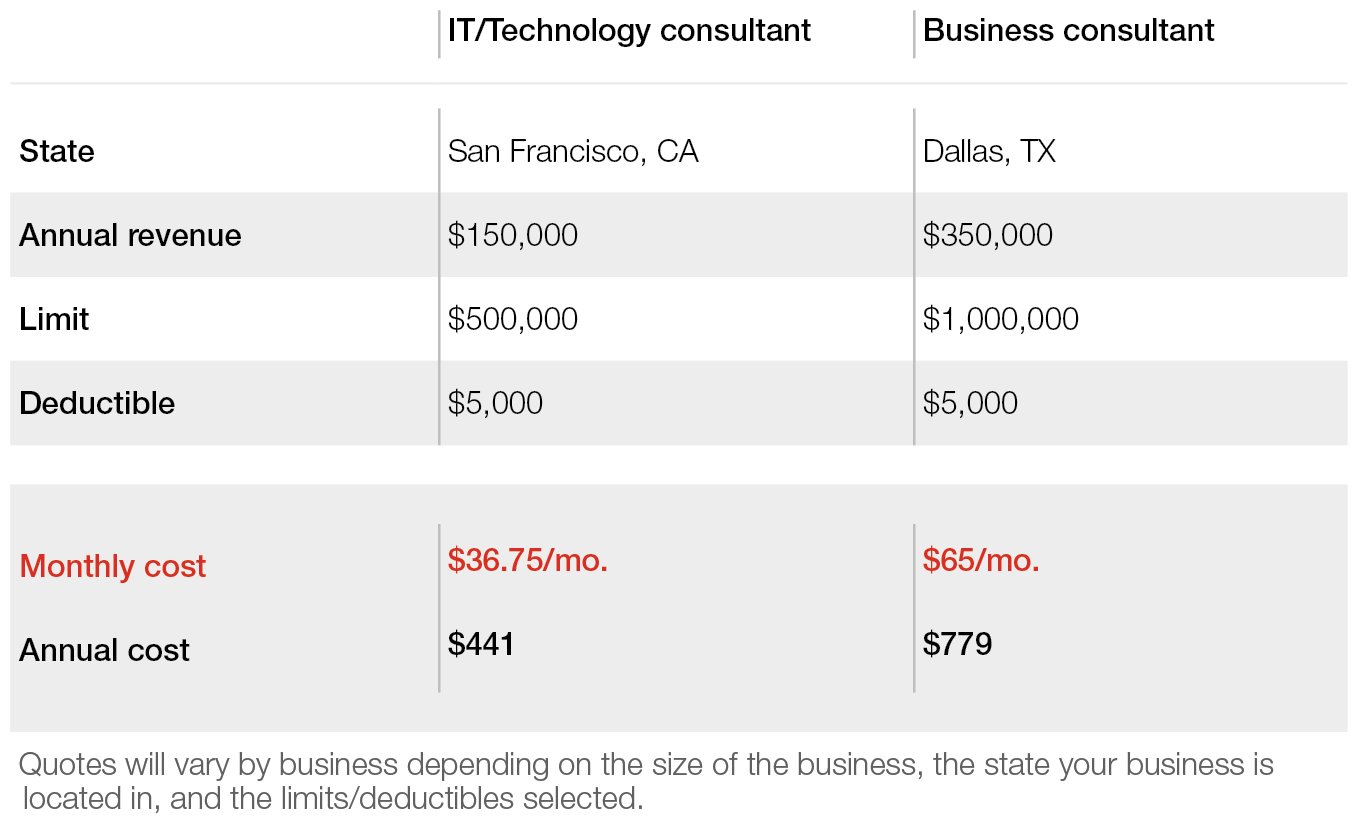

Coverage Designed Specifically For Your Pennsylvania Business

Pennsylvania business owners should consider purchasing financial and legal insurance. reasons. Customer injury, natural disasters and professional negligence are just some of the manySituations that can lead to lawsuits as well as costly recovery costs that are often difficult to manage without insurance.

What is insurance and error omissions? Omission and error insurance is another name for cooperation with professional liability insurance. Thus, in this way you get the same coverage despite these different names.

What Is E&O Insurance?

For those who provide specialized services when your clients rely on your expertise, error and omission insurance provides coverage for errors in judgment or substandard work, or when you do not provide the services your client needs. needs. An annoyance that most don’t realize is that a general insurance policy excludes these types of services from coverage. From contractors to technology to commercial enterprises, the list of companies for which E&O needs insurance is very broad.

A professional dispute, such as a claim related to harassment, wrongful sexual dismissal, courtesy at work, and other similar claims, is certainly not covered by your E&O policy. You may be covered by professional liability insurance (EPL). False advertising.

Pennsylvania Error And Omission Policy Benefits:

Your Pennsylvania insurance coverage will vary depending on your preferred error and omission insurance company. Please contact ORA at 1-800-472-7004 or visit us occasionally at orawarranty.com and our dedicated staff.The ckics will be happy to assist you with your Pennsylvania error and omission insurance requirements.

The software to fix your PC is just a click away - download it now.Error and omission (E&O) insurance is considered a type of professional liability insurance that protects businesses, their employees and other professionals from claims due to poor workmanship or negligent actions.