Table of Contents

If you understand the difference between alpha tracking errors, this article is here to help you.

Approved

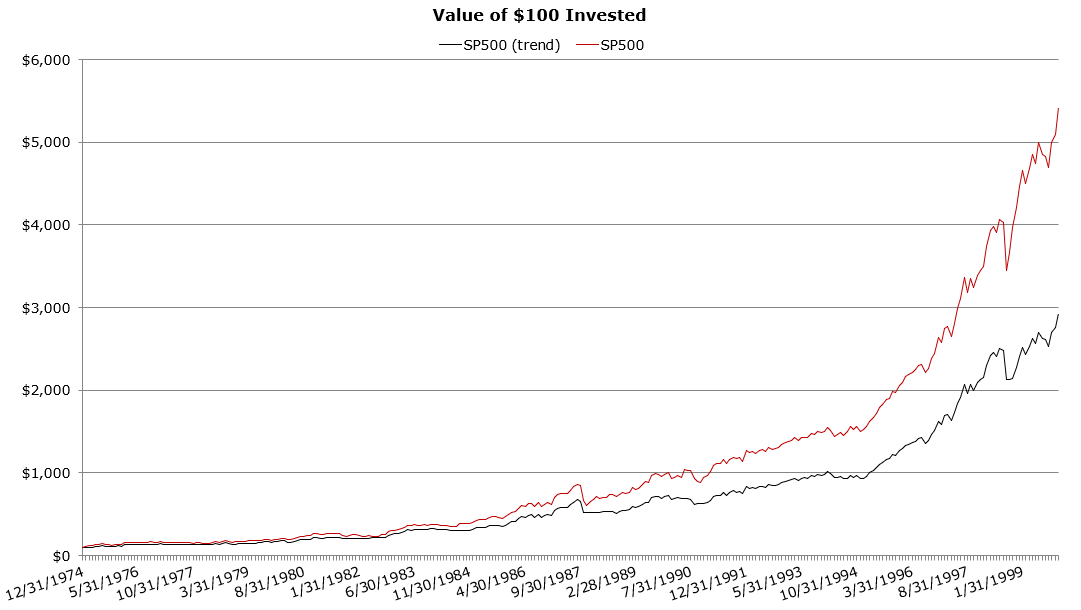

Alpha is the profitability of active media over a certain period of time. Since the running error usually measures the standard deviation of a portfolio’s rigid performance, it is different from the alpha dog. A portfolio will not exhibit a trailing error simply because it is associated with superiority or underperformance.

What Is A Tracking Error?

The tracking problem is the mismatch between the behavior of the position premium, or perhaps portfolio, and the price behavior patterns of the benchmark. This is common in the context of hedge fund, mutual fund, or exchange-traded fund (ETF) in general, preventing it from working. just as effective as a job designed to make an unexpected profit or loss.

![]()

The tracking error will be reported as a margin of standard deviation indicating the difference between the return the investor receives and the return from the benchmark that he is likely trying to mimic.

Understanding The Error

While tracking difference typically measures how much the performance of an index member differs from that of a benchmark, tracking error indicates the variability between your own data points, which is the average tracking difference of your current fund.

Because choice risk is often measured against an actual benchmark, tracking error is a widely used metric to measure investment performance. Tracking error shows the consistency of an investment relative to a benchmark over a period of time. Even portfolios perfectly indexed to the benchmark will behave differently from the benchmark, although the differences between the components on a daily, quarterly, and annual basis may be small. A measure of observational error is used to quantify this large difference.

Tracking error is the standard deviation associated with the difference between the return on all investments and their benchmark. Given a sequence of returns for a good investment portfolio or its standard, the tracking error is calculated as follows:

In terms of solid investments Well, the progression error can be used to test portfolio managers. When a manager sees a low average return and a large tracking error, it is a unique indication that something is wrong with that investment and that particular investor should most likely get a replacement.

Approved

The ASR Pro repair tool is the solution for a Windows PC that's running slowly, has registry issues, or is infected with malware. This powerful and easy-to-use tool can quickly diagnose and fix your PC, increasing performance, optimizing memory, and improving security in the process. Don't suffer from a sluggish computer any longer - try ASR Pro today!

It may also be necessary to predict performance, especially for quantitative portfolio managers who create models of risk regimes that include factors that may influence these price changes. Managers then simply create a portfolio that uses all sorts of standard ace components (such as style, leverage, momentum, and possibly market cap) to create an investment portfolio that has one major flaw that closely matches my benchmark.

Special Considerations

Factors That May Affect Tracking Error

Of course, the

In addition to fees, a number of other factors can contribute to a fund’s tracking error. The fundamental factor is the extent to which the stock of stocks matches the assets of the underlying index or standard. Many funds consist solely of the fund manager’s idea, the most recent representative sample of the stocks that make up the actual list. Often there are also net weight differences between fund assets and index assets.

Illiquid stocks or stocks that trade sluggishly can also increase the chance of a tracking error, as this can cause prices to differ significantly from the retail price when the Fund reRegularly buys stocks or such securities at close higher rate – ask for spreads. Finally, the volatility of all levels of the index can also easily contribute to the tracking error.

Premium Discounts And Net Asset Value

A Premium or Discount to Net Asset Value can occur when investors price an ETF above or below the Net Asset Value of its basket of securities . Such deviations are usually very rare. In the case of a premium, this is usually arbitrated by the Authorized Executor by purchasing the price Selling shares on the stock exchange for some profit (until the premium disappears) Premiums and discounts of up to 5% are known, especially for ETFs with low trading.

Optimization

If there are virtually no stocks traded in the benchmark dataset, the ETF provider cannot buy them all without causing their prices to skyrocket, so it uses a composite sample of more liquid stocks to represent the index. This is called a search engine optimization portfolio.

Diversification Limits

The ETFs will be registered with regulators as mutual funds and will comply with the relevant regulations as necessary. Pay attention to diversity requirements: 75% of assets are invested in cash, government shares and securities of other owners of investment organizations, and no more than 5% of total assets can be invested in one security. ETF tracking issues are currently impacting the performance of the sector I currently operate in many large companies.

The software to fix your PC is just a click away - download it now.Alpha, often referred to as active ROI, measures the overall performance of an investment relative to the current market index or benchmark, which is designed to representation of the general movement of the market. The excess of the return on investment over the return on the benchmark is the alpha of the investment.

Tracking error is usually the difference in actual performance between a position (usually the entire portfolio) and the corresponding benchmark. A difficult error to observe can be considered as an indicator of the managerial activity of the established fund and the likelihood of this.

Tracking error also plays a role in determining how “active” each manager’s strategy is. The smaller their tracking error, the closer the company is to the benchmark. The higher the human tracking error, the more the forex broker deviates from the benchmark.